Swiss Life Asset Managers, Homes England and Capital&Centric establish joint venture that will deliver £860m of mixed-use residential development

Swiss Life Asset Managers and Homes England join forces with Capital&Centric to launch a new joint venture, The Impact & Places Partnership that is expected to deliver over 2,250 new homes in underinvested regions throughout England.

Swiss Life Asset Managers has entered a strategic joint venture with the UK government’s housing and regeneration agency, Homes England, and multiple award-winning social impact developer, Capital&Centric, to deliver more than 2,250 homes in underinvested areas in England.

The joint venture, The Impact & Places Partnership, will deliver more than £860m of new high-quality homes over the next decade in regions where demand for housing is most acute.

Under the terms of the agreement, Swiss Life Asset Managers and Capital&Centric will take a combined 60% stake in the joint venture.

Steve Reed, Secretary of State for Housing, Communities and Local Government, said:

“We will get Britain building again by backing brilliant homegrown developers like Capital & Centric, and bringing in major institutional investors like Swiss Life Asset Managers, to build the homes this country desperately needs. We are pulling every lever to fix the housing crisis and its exactly this kind of deal that will help us build the 1.5 million homes, faster, and in the communities that need them most.”

Swiss Life Asset Managers is a leading European asset manager and real estate investor with £259bn of assets under management that provides responsible and sustainable investment solutions for institutional and private investors.

Jan Plückhahn, Head of Real Estate at Swiss Life Asset Managers, said:

“Swiss Life Asset Managers has a strong residential investment heritage, and this joint venture expands our ambition to develop housing solutions beyond our traditional markets in Switzerland, Germany and France. We look forward to bringing our financial strength and expertise, as one of Europe’s longest-standing financial institutions, to the partnership.”

Homes England is the Government’s housing and regeneration agency, with the aim of driving the creation of more affordable, quality homes and thriving places so that everyone has a place to live and grow. Homes England makes this happen by working in partnership with thousands of organisations of all sizes, using its powers, expertise, land, capital and influence to bring investment to communities and get more quality homes built.

Simon Century, Chief Investment Officer at Homes England, said:

“Attracting institutional investment into the housing sector is critical to build the new homes the country needs and contributes to the government’s ambition to build 1.5 million new homes in this parliament. This new joint venture aims to develop high-quality, mixed-use residential schemes and brings together Swiss Life’s real estate experience and expertise with Capital & Centric’s impressive residential-led placemaking focus. Our investment in this joint venture is further evidence of our commitment to attract private capital into the residential market, while supporting small and medium developers to realise their own housebuilding ambitions.”

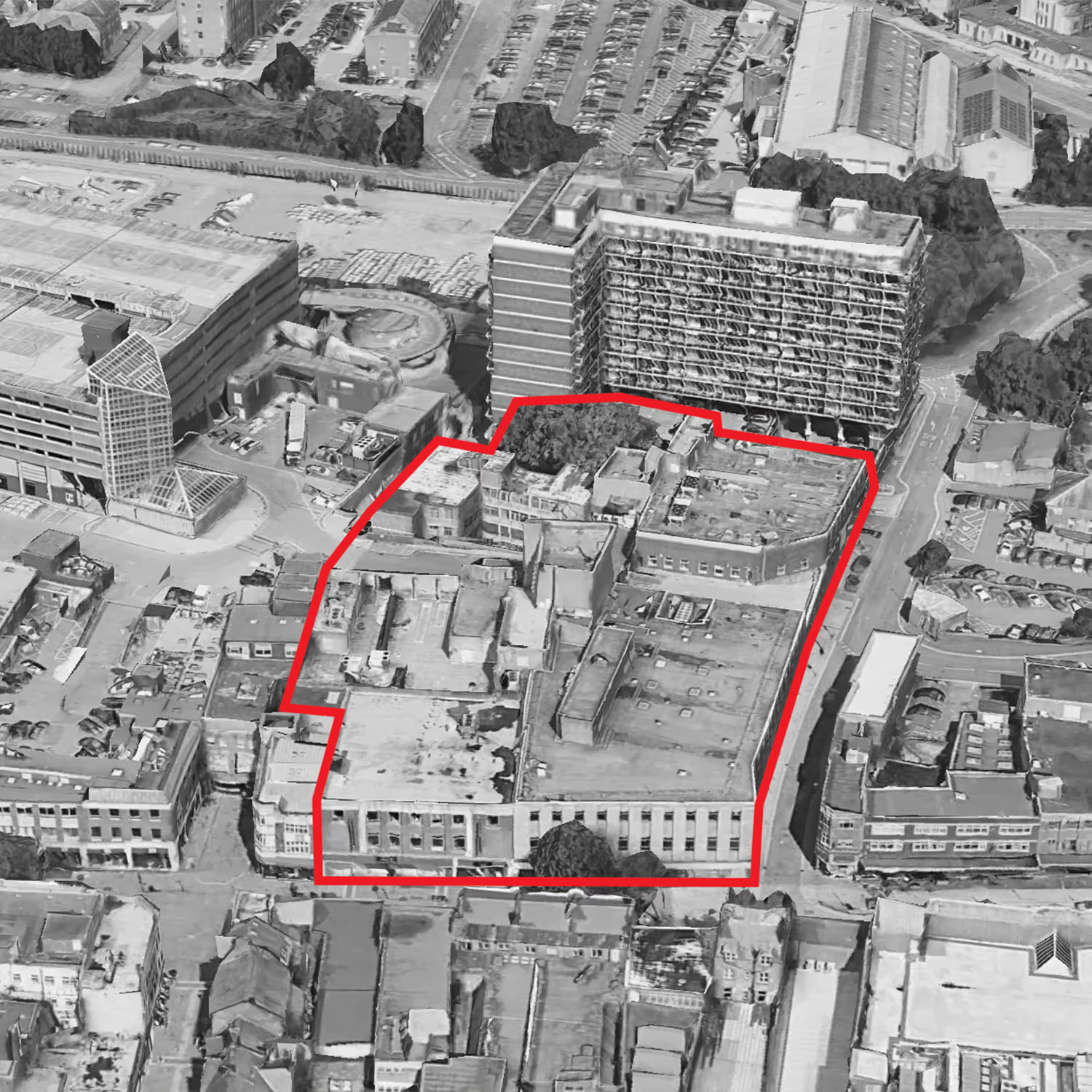

Capital&Centric is a UK-based regeneration specialist transforming unloved land and buildings into vibrant, design-led neighbourhoods that revitalise communities. As a social impact developer, it prioritises sustainability, great architecture, and community-focused design to create inclusive, energy-efficient places where people can live, work, and socialise. Some of its completed projects include Goods Yard in Stoke-on-Trent and Kampus in Manchester.

Tom Wilmot, Joint Managing Director of Capital&Centric, added:

“This joint venture brings together three like-minded partners focused on delivering high quality neighbourhoods in a range of locations. Not just in core cities but also in under-invested locations where the impact story is more compelling and the supply and demand dynamics are more favourable. This demonstrates that risk management, long-term returns and delivering positive social change are not mutually exclusive. Because doing good and doing well can, and should, go hand in hand."